The Hidden Kill Switch in the Defense Logistics Agency's Rare Earth RFI

How reading the fine print redefines the trade—and why regulatory survivability might beat superior chemistry.

While the retail market is chasing “free money” from Department of Energy grants, the real strategic value—Defense Department procurement—just showed its hand. Just a few days ago, the Defense Logistics Agency (DLA) quietly released a Request for Information (RFI) largely unnoticed by the broader market. The notice, SP8000-26-RESP, seeks a contractor to separate 12,600 kg of government-furnished Rare Earth Oxides (REO).

Normally, we would analyze this offering by asking which company has the right separation technology for the supplied oxides. However, buried in that RFI is a single sentence that could transform the conversation from a question of chemistry into a question of regulatory survival.

I. The Feedstock Composition

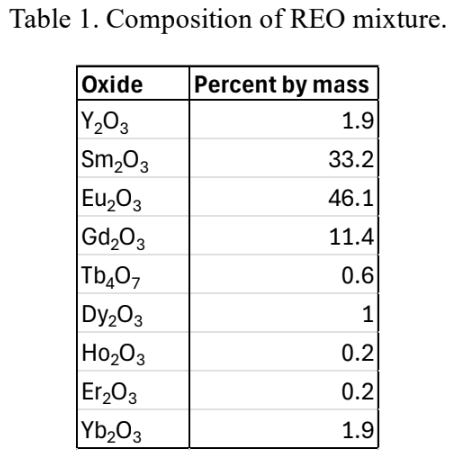

The specific chemical mix the DLA is offering is somewhat unique. According to the RFI solicitation, the composition of the REO as follows:

The 12,600 kg batch is not a typical light rare earth concentrate (which would be mostly Neodymium and Praseodymium, like what MP Materials produces). Instead, the DLA batch is heavily weighted toward the “middle” of the rare earth spectrum. Over 90% of the mass is comprised of just three elements:

Europium Oxide: ~46.1% (Very high value, critical for defense/electronics)

Samarium Oxide: ~33.2% (Used in high-temp magnets)

Gadolinium Oxide: ~11.4% (Used in medical imaging, specialized alloys)

This is called SEG Concentrate (Samarium-Europium-Gadolinium).

Separating these rare earths is difficult because they are chemically very similar. The hardest separations are between elements that sit right next to each other on the periodic table (adjacent atomic numbers).

In this DLA batch, the three primary elements are direct neighbors:

Samarium (Atomic #62)

Europium (Atomic #63)

Gadolinium (Atomic #64)

Separating Europium from Samarium and Gadolinium is time-consuming and expensive using traditional methods. It requires hundreds of mixer-settler stages to achieve high purity (e.g., 99.9%+).

II. RapidSX to the Rescue

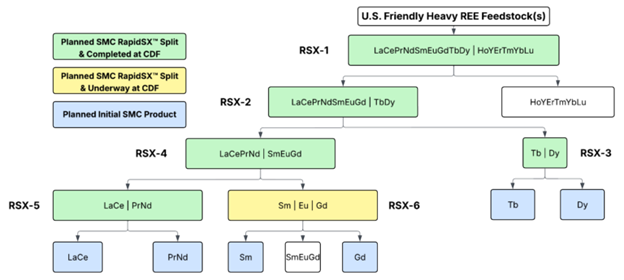

If we were looking at this composition on it’s face and asking “Who could most feasibly do the job?” a sensible answer would be UCORE Rare Metals. This midstream player doesn’t use traditional Solvent Extraction (SX), which relies on massive tanks (mixer-settlers) and gravity. They use a proprietary technology called RapidSX. This column-based technology speeds up the transfer of mass between liquids. UCORE claims this allows them to:

Perform difficult separations much faster (days instead of weeks).

Use a much smaller physical footprint.

Achieve purities of 99.5% to 99.99% more efficiently.

UCORE has spent the last two years at their Kingston, Ontario demonstration facility specifically proving they can separate heavy and medium rare earths. In fact, their recent demonstration campaigns have focused intensely on the exact SEG separation challenge the DLA is presenting. That is, they have explicitly targeted separating Samarium, Europium, and Gadolinium.

That makes for a potentially convincing argument in their favor:

The “Chemistry-First” Argument: If you are the DLA, and you have a 12-ton batch of difficult SEG concentrate, you don’t want a generalist. You want a specialist who has just finished practicing on that exact problem. UCORE could reasonably be considered that specialist.

III. The Kill Switch: Section B(xi)

However, there is a catch. The DLA knows that separating Rare Earths carries a dirty secret: when you isolate the valuable minerals, you concentrate the trace radioactive impurities (Thorium and Uranium) into the waste stream. In Section B(xi) of the RFI document, the DLA asks vendors to consider a question with the following constraint:

“If your process cannot prevent concentration of U and Th, please provide responses to Question B(iii) assuming your operation is required to be discontinued once any material fraction reaches a combined concentration of U + Th = 0.05% mass.“

Why does this question matter?

0.05% (500 ppm) is a key regulatory threshold that can trigger “source material” handling and licensing burdens—even if the incoming material is initially compliant. If a factory hits this limit, it typically requires a Part 40 Radioactive Materials License to continue operating.

Most midstream competitors (UCORE, ReElement, MP Materials) operate under light industrial permits or state-level exemptions. They generally cannot legally handle material above this limit without stopping operations.

The DLA is effectively asking: “When your waste turns radioactive, do you have a license to keep running, or do we have to shut you down?”

In other words, even if the feedstock arrives below regulatory thresholds, the physics of separation works against the processor. To get 99.9% pure Europium, you must strip away the impurities. Those impurities (including Thorium) don’t disappear—they concentrate in the waste stream.

The moment that waste stream crosses 0.05%, an unlicensed contractor faces a regulatory failure mode. A “Kill Switch.” A licensed contractor does not.

IV. The Trade: Risk Allocation vs. Chemistry/Technology

It’s reasonable enough to assert that this RFI reveals that the DLA is pre-emptively hoping to solve for Risk, not just Purity. There are two realistic ways this contract plays out if that is true. I wager that understanding the difference is a way to understanding a potential edge in forecasting winners.

Path 1: The “Turnkey” Solution

The DLA decides they want zero liability. They write the final contract to say: “Contractor is responsible for the disposition of all waste streams.”

This might narrow the field rather dramatically - or rather, it might give the edge to a competitor of UCORE. That competitor is Energy Fuels.

Why? They own the White Mesa Mill, which is one of the only currently operating, fully licensed, commercial-scale options in the U.S. for handling and disposing of U/Th-bearing residues.

Moreover, they are also working on rare earth separation and midstream with commercial rare earth production anticipated for Q4, 2026. They are already producing light rare earths at the Mill. Now, they have set their eyes on the rest of the ensemble, having recently finished their piloting of Dysprosium and presently working on piloting Terbium. After these heavy rare earth pilots are completed, their next sight is on Gadolinium and Samarium. They also list Europium in a recently updated feasibility study.

They are the only candidate who can answer Section B(xi) by saying, “We don’t have to discontinue. We are licensed for this.”

Path 2: The “Competitive” Solution

The DLA decides they want the best technology and are willing to take the waste back to ensure competition. They write the contract to say: “Government retains title to waste.”

This opens the door for other players like UCORE or ReElement (or a Teaming Consortium) to win the Prime contract based on their superior chemistry alignment for this specific mixture.

The Catch: This outcome depends on the DLA being willing to retain or centrally manage radioactive residues, which is historically less common, though not unprecedented. Even in this scenario, the waste has to go somewhere, likely forcing the winner to team with a licensed partner. Energy Fuels still retains viability here too, even if only as part of the team.

V. The Scorecard: Candidate Players and their Profiles

1. Energy Fuels (UUUU)

Role: Continuity of Operations and the Regulatory Safety Net

Thesis: Section B(xi) forces every bidder to have a plan for “hot” waste - and White Mesa is the gold standard for that plan. It’s baked in. They can easily act as the regulatory sink for the radioactive byproduct.

2. UCORE Rare Metals (UURAF)

Role: The Chemist with the Technological Upside.

Thesis: Their RapidSX technology is arguably the best technical fit for the specific Sm/Eu/Gd mix in the table presented at the outset of this article.

If the DLA chooses the second path - that is, if they are structuring the contract to allow competition - then UCORE is a plausible winner. That is, provided they find a way to handle the waste disposal.

3. ReElement – The Wildcard

Role: The Washington Darling.

Thesis: ReElement has undeniable momentum. Just a few days ago, they announced having produced greater than 99.9% pure Samarium. That timing with the RFI is rather coincidental, don’t you think?

Beyond that, they have largely been coming across as the preferred bet from Washington D.C. on domestic rare earth separation and midstream. OK - that statement is a bit of hyperbole. The USA is certainly not betting on one horse. But there is no denying they have made some serious traction over the last few months in the race for dominance in the sector.

You might consider, for example, the recent highlighting of their potential J.V. with POSCO International in the White House Fact Sheet emerging from trade talks in South Korea or the $1.4 billion partnership they have recently secured between the Office of Strategic Planning (OSC) and Vulcan Elements. There is also the partnership with the Republic of Uzbekistan that was a fruit of the C5 + 1 summit.

All that spotlight makes sense: their chromatographic method espouses high purity, modularity, low capex, low environmental footprint. Nonetheless, their Indiana facility lacks the regulatory shield for this specific radioactive risk. However, their chromatography platform may still prove economically decisive inside a licensed facility, even if they are structurally disadvantaged otherwise.

VI. Next Steps and Considerations

The RFI responses are due February 11.

Down the line, if UCORE or ReElement (or another company) announces a submission or partnership with a “Licensed Waste Management Partner,” that is a signal. It means they solved B(xi).

And when the solicitation itself drops (likely in a few months), will there be crumbs to follow?

If we see confirmation that “Contractor Disposes” → this supports the idea that the DLA may favor Path 1 (Advantage Energy Fuels).

If we see confirmation that “Government Retains Title” → this supports the idea that the DLA chose Path 2 (Advantage UCORE or ReElement).

The Bottom Line: The real edge may not always come from understanding the chemistry or the technology. It may also come from understanding who owns the right regulatory model. Let’s see how this dance shakes out.

Best wishes,

Steve

Disclaimer: I am not in the business of giving financial advice. That is, I am not a financial advisor. None of what I say here is a recommendation to hold or not hold shares or other instruments of any particular company or series of companies. All that is contained on my page is research in which I convey and substantiate personal views and commentary about sectors, economic policies, and various industries. . As always, please do your own research and understand the risks involved before placing any trades. I am not responsible for any of the decisions you choose to make.

check out who is sending praise that direction

https://finance.yahoo.com/news/ucore-rare-metals-applauds-trump-160500437.html

Fascinating! The DC winds are whispering, very excited to see if they blow any bread crumbs our way.