Understanding Valuations in Critical Minerals and Energy

How do we value rare earth and energy companies?

Hi all,

We had a lot of questions submitted and it will take me some time to answer the ones that I can. I won’t make one of these formal posts for every single question I answer but I did want to give at least a little content today. So, here is one question asked that had a lot of support behind it. For those just joining us, these questions were sourced over a period of days by solicitation in the substack chatroom. Join us next time!

Question #1 from CM: What are your thoughts on current pricing of NB, UAMY, CRML, AREC, USAS and UUUU? I’m seeing a lot of pull back and looking for good reentry where I don’t have to see deep red for the next 2 years.

+ #2 from Janis: With constant good news entering the sector, stocks are mostly still red. Some seem to stabilize a bit but still, the sentiment is extremely bullish when reading news and updates and yet nothing is happening.Question: when do you think/speculate a green wave will return? Or at least a slow uphill movement. I‘m personally feeling optimistic but also hesitant to double down in case we might see further downhill movement. Having entered close to the top I want to try as best as I can to DCA well.

+ #3 from Dennis: Hi Steve. What do you think the size of the western REE market will be over the next five years?

+ #4 from Maximus: How do you analyze a market? How do you analyze a company?

I spend a lot of time thinking about the first question and a clear answer is difficult to come by. Allow me to get into the weeds of it for a minute in order to tell you why. Then, I’ll scope out a bit at the end and try to be more actionable.

I would say we can start to answer this question by first considering how much market there is to capture and then evaluate the present and near-term positioning to capture that market alongside the execution and peer-competition risks involved. In reality, this is extremely hard to do because (1) the western chain and the economic supports/incentives the sit underneath are still only starting to take shape and (2) intergovernmental cooperation across western countries and their partners in various regions of Asia is increasing at a breakneck speed, which changes both the market share landscape and the types of support that can be tapped (we already know the levers in the USA, which have been expanded thoroughly: DoD Title III, DoE EDF, DFC, OSC, EXIM. Have we properly considered Australia’s EFA/equity, levers from Japan’s JOGMEC, JIBC, METI, Korea’s MOTIE, G7 instruments, C5+1 streams? What about the increasing role of private-sector capital being used in parallel?)

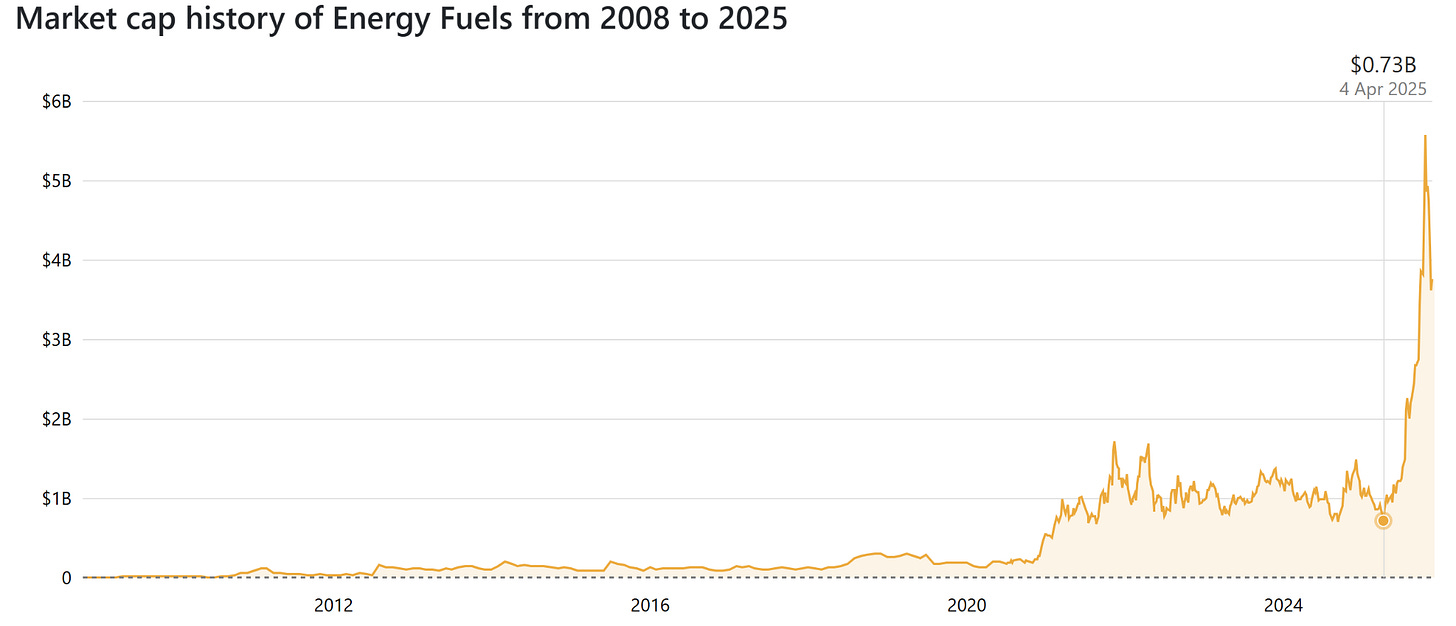

Regardless, we have seen a lot of mania lately with most of the companies you list. Here is an example. Back when I started writing about Energy Fuels, it had a trading-based market cap around 73M-100M. In the last few months, we saw it take off reaching a high of about 5B. How much of that is pure retail and news-driven mania?

It’s honestly difficult to know because the ceiling is no longer particularly easy to ascertain. There is certainly less room for absolute upside than there was a few months ago. At the same time, the ceiling has also been raised, likely dramatically.

And we haven’t considered the fact that all of these companies are in some way uniquely different from one another in market target even when they appear similar on face. Energy Fuels and ReElement (AREC spin-off, 19% stake retained) are seen as competitors in many ways. And in a way that is true. But how easily can we compare them? Energy Fuels has a section of the uranium chain cornered whilst ReElement has no exposure in that area at all. Energy Fuels uses a cumbersome solvent extraction method for midstream which pollutes heavily and is more capital-intensive but which is tried and true for commercial output. Meanwhile, ReElement has recycling capabilities that Energy Fuels doesn’t and the ability to achieve purity levels that are incredible across the catalogue of critical minerals. They also have the rights to their capex efficient IP which they will likely license out. The downside, on the other hand, is that they still have a large degree of execution risk in play to demonstrate commercial scaling is possible with their approach.

I wish we could just compare midstream to midstream and get a sense of what is overvalued vs. undervalued in present market conditions. But alas, each company presents as a beautiful and unique snowflake that makes such analysis so very difficult.

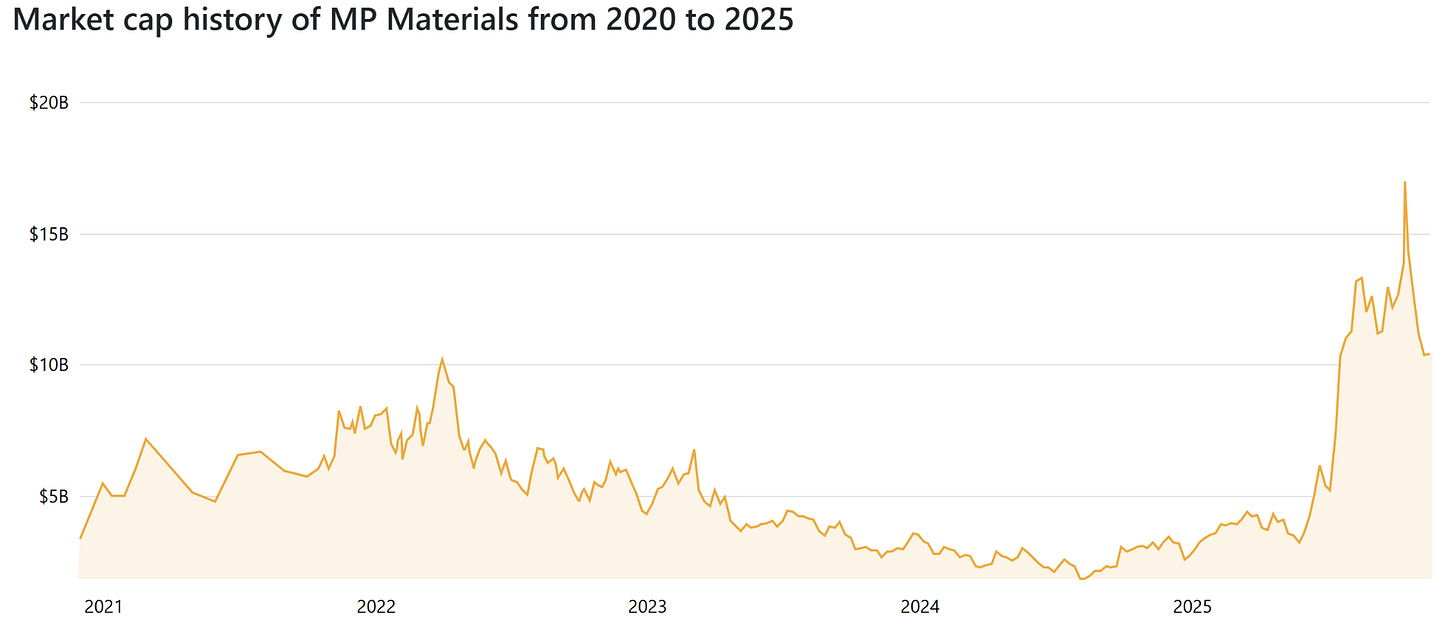

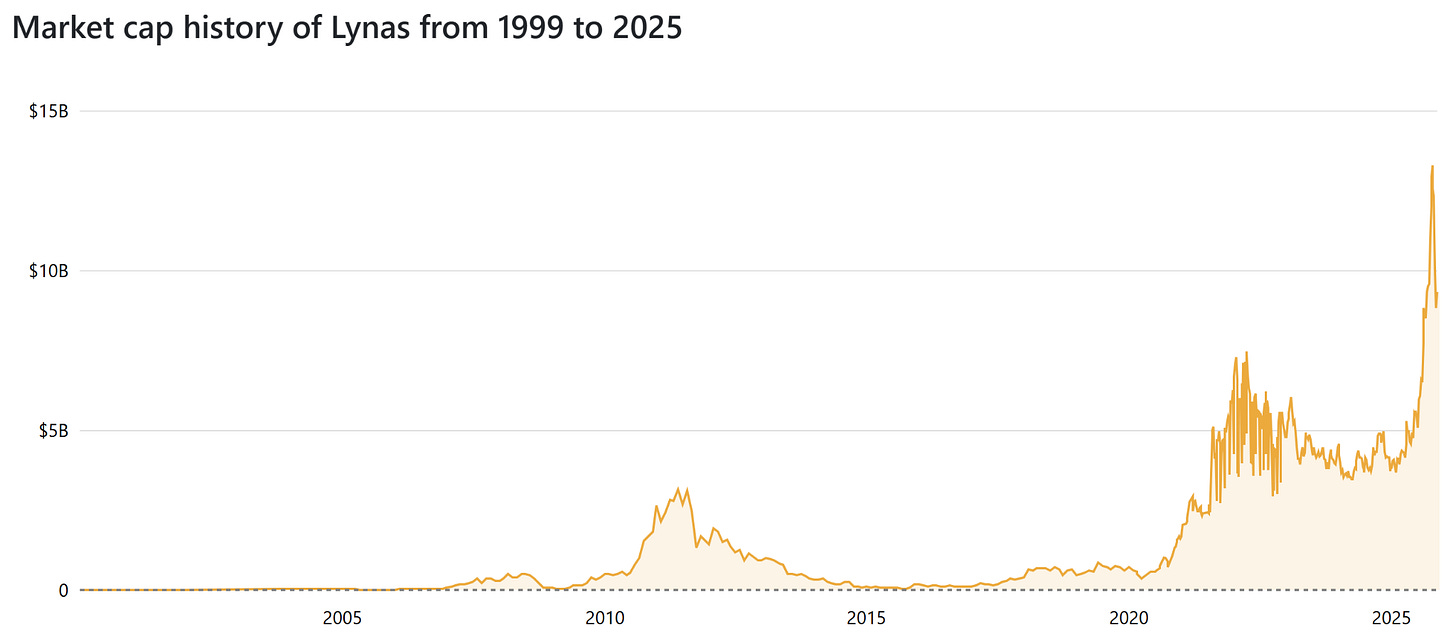

We could look at the western champions and where their market caps are presently in order to get a better sense of things. But even that is not so easy to do in reality. MP trades on its commercial and first-mover success in the United States. They also trade at premiums because of their movements in vertical integration - an area which neither Energy Fuels nor ReElement are attempting to corner. Lynas is a bit more upstream/midstream focused, but they are also aiming to expand out in vertical integration. Still, I like the idea roughly of thinking that the market cap of the few established players can serve as a heuristic to understand where near-term commercial competitors could get to.

Realistically, a strong midstream competitor could realize at least a valuation pro-rated to these to exclude an estimate of how much is coming from their venture into parts of the chain beyond midstream. That doesn’t really capture what is really here though, because these market caps themselves have (in my view) not come close to aligning with their realistic value either (for better or worse - I will say these established players trade at very high forward multiples). And again, part of the issue here is that economic policy and bilateral trade support is emerging in a way that the market doesn’t yet see and, to be honest, even if they did see it I’m not sure they would know how to really price it yet.

OK - so, I could go on and on about this, but let’s get out of the murky waters and scope out a bit so I can say something that folks might find a little more general and actionable (or not).

Here is what I attempt to do generally speaking:

First and foremost, if you can, try to shift your outlook on investment timeline and tolerance for delayed gratification as much as possible. It’s much easier to locate a good candidate for high return than it is to estimate when that return will come.

Barring that (or in addition), look for companies that have near-term catalysts that will raise the odds that they lift to profitability sooner rather than later. Which candidates are positioned for massive government support and partnerships (e.g. piloting close to done, demand high, viable execution, feasibility work in progress and demonstrated history). Example: there is so much hype about NB. And there is some good reason for that - they are targeting a niche that would be very valuable. But even if they got all their financing in place today, they wouldn’t realistically have sizable output until 2029. That is a LONG time to be waiting. Accordingly, I’d probably rank them lower than the others unless the play was for a short term news-related financing hike. Same goes with CRML.

Among the candidates you identify, which are trading at a larger discount relative to their closest peers? Back when I first started trading Energy Fuels and became interested in others like ReElement (I know you said AREC, but I’m just going to talk about ReElement as I think most of AREC’s value really comes from their small stake and collaboration with ReElement), it was rather obvious to me that they were being slept on. UCORE too. The valuations of the closest established western peers made it easier to see. I wish it was the same nowadays, but in some ways the cat is at least partially out of the bag. A few limbs or a tail at least.

Look for unique elements of the candidates that make short-term lift exceedingly likely. Energy Fuels is sitting on massive amounts of uranium as economic and geopolitical policy is positioning to have that sector booming. Moreover, they are right on the cusp of feasibility completion for the Donald Project and White Mesa + terbium piloting + pending negotiations with Posco and Vulcan. That raises credence that the levels we are seeing right now are not likely to stay so suppressed and so would make the present prices feel more palatable even though they still trade at a premium to what they were before (e.g. when I got into Energy Fuels, at $3 a share).

ReElement is again an interesting case - it has a massively disruptive technology behind it which is seeing increasing validation. It requires less environmental fuss and infrastructure build, less capex, high purity. They also have a negotiated Posco MOU for a partnership to build a refining/magnet complex. That raises the credence that there is going to be further lift sooner rather than later (although, be cautious, as it is one thing to invest in AREC and another ReElement, though the former ties to the latter do make for downstream tailwind support).

Broadly speaking, what we have seen happen in the market lately is painful but not at all surprising to most of us. I flagged it in my research post before the China negotiations - that the outcomes would be a highly binary event in the near-term that could move share prices down a lot. Now, I think the market has likely overemphasized the impact of those negotiations (thinking they changed more than they really did for the landscape of the western sector) and over time the deluge of support and policy streaming in will perhaps steady the ships a bit. Retail is also a rather skittish creature - and it appears to me that the mania has died down a bit - which is hopefully good news. I would like us to get to a point where the sector once again responds to positive news and milestones in a way that it has failed to in the recent weeks following the trade talks.

But as always, there are no guarantees in the market…

Hope this is helpful to consider for you all.

Love,

Steve

Disclaimer: I am not in the business of giving financial advice. That is, I am not a financial advisor. None of what I say here is a recommendation to hold or not hold shares or other instruments of any particular company or series of companies. All that is contained on my page is research in which I convey and substantiate personal views and commentary about where sectors, economic policies, industries, so on, may go. As always, please do your own research and understand the risks involved before placing any trades. I am not responsible for any of the decisions you choose to make.

Steve again, I think I can speak on behalf of many of us, when I say we seriously appreciate your insights and the time you take to help offer your view of the current situation. Thx again, take care, and I hope everyone has a good rest of their weekend.

Thanks Steve for making the effort. Appreciate! I can hear the WSBs "all in xyz" 😁 …

Shame, that Substack has no build in translation function. My English is not bad, but sometimes I struggle with analysis which can be challenging even in my mother tongue.