Critical Minerals: Four Catalysts

What will move the rare earth market next?

Hi all,

I wanted to briefly highlight four catalysts largely still unrealized in the critical minerals sector. I expect these to continue to feed a sector wide run this coming quarter into early next year.

1. Section 232 Tariffs Pending October-December

Although many have confused this with the administration’s order modifying the scope of reciprocal tariffs, the Section 232 investigation into the national security threat that critical minerals pose and the possible tariffs that may result is a separate process that remains unresolved. Initiated back in April, the investigation order gives cabinet members and those designated by the president until sometime in October 2025 to produce a report on the relation between critical minerals and our national security. After this report is submitted, the president will have two months to decide whether to impose tariffs on the basis of its finding.

The outcome is about as obvious as you can imagine - with China having rolled out export controls back during the beginning of the trade war a number of months ago and our defense industry still struggling to supply themselves with the relevant magnets and materials.

We have seen these investigations result in tariffs for copper and, interestingly enough, graphite has also had tariffs levied upon it by the administration, despite the fact that our own production of graphite is highly constrained. This signals that light and heavy rare earths (the latter which we have almost no domestic production yet) may not be as unthinkable as I would have otherwise believed when I first began researching this sector.

2. Uranium and Critical Minerals Stockpiling

This has been in the works for a while and we are finally beginning to see some movement on it, with a recent announcement regarding uranium and an inkling a while ago pertaining to the deep sea bed. I expect that stockpiling initiatives for other critical minerals will follow.

We haven’t yet seen purchasing agreements roll out with specific suppliers. But we will begin to have those trickling in sooner rather than later - with the USA sensitively aware of how reserves could have alleviated a shuttering of a number of industries, as we saw with automakers having to forfeit production when the supply was critically constrained by China’s bottleneck.

3. DPA/DOW/DOE/DOI Grants, Financing, and Investments

I have mentioned this before, but the MP materials deal with the Pentagon we saw back in June isn’t meant to be a one off. Through more-or-less every avenue available to them, the white house has strategically positioned themselves to open up funding to promising rare earth and critical minerals companies that process, mine, and develop products domestically across the supply chain.

They have signaled as much, broadly speaking, and have quietly made movements in the last number of weeks to provide this funding through the Defense Production Act, the Department of Defense/War, the Department of Energy, and the Department of the Interior. Recently, the administration has also been in talks to set up a 5 billion fund for critical minerals projects.

4. Public and Private Partnership (e.g. Microsoft?) and Relations with Australia

Back in July and August, White House Advisor Peter Navarro met with a number of privately held companies working in the western critical mineral supply space. Alongside Navarro, were giants like Microsoft, Apple, and Corning, which each depend on these materials for the continued growth and success of their respective industries.

Following the MP materials deal with the Pentagon, Apple invested 500 million to further assist the US in moving the dial on domestic production.

What we have seen with other companies following this has been a steadfast pattern - one explicitly mentioned as an expectation and desired outcome by the administration - which is partnership between public and private companies. ReElement, for example, has since partnered with Vulcan Elements, then received a DoD/DoW grant soon after. Energy Fuels also announced an agreement with Vulcan rather recently. Relatedly, there has been further discussion about partnership between Australia and the USA in this sector. Subsequently, we have seen UCORE enter into a partnership with Metallium Limited. Lynas, of course, is perhaps the greatest western-aligned Australian ally in this sector.

Apple, as we have seen, has has laid down their contribution. Where are other giants like Microsoft going to fit in the picture? We have yet to see them throw down the gauntlet in the same kind of way.

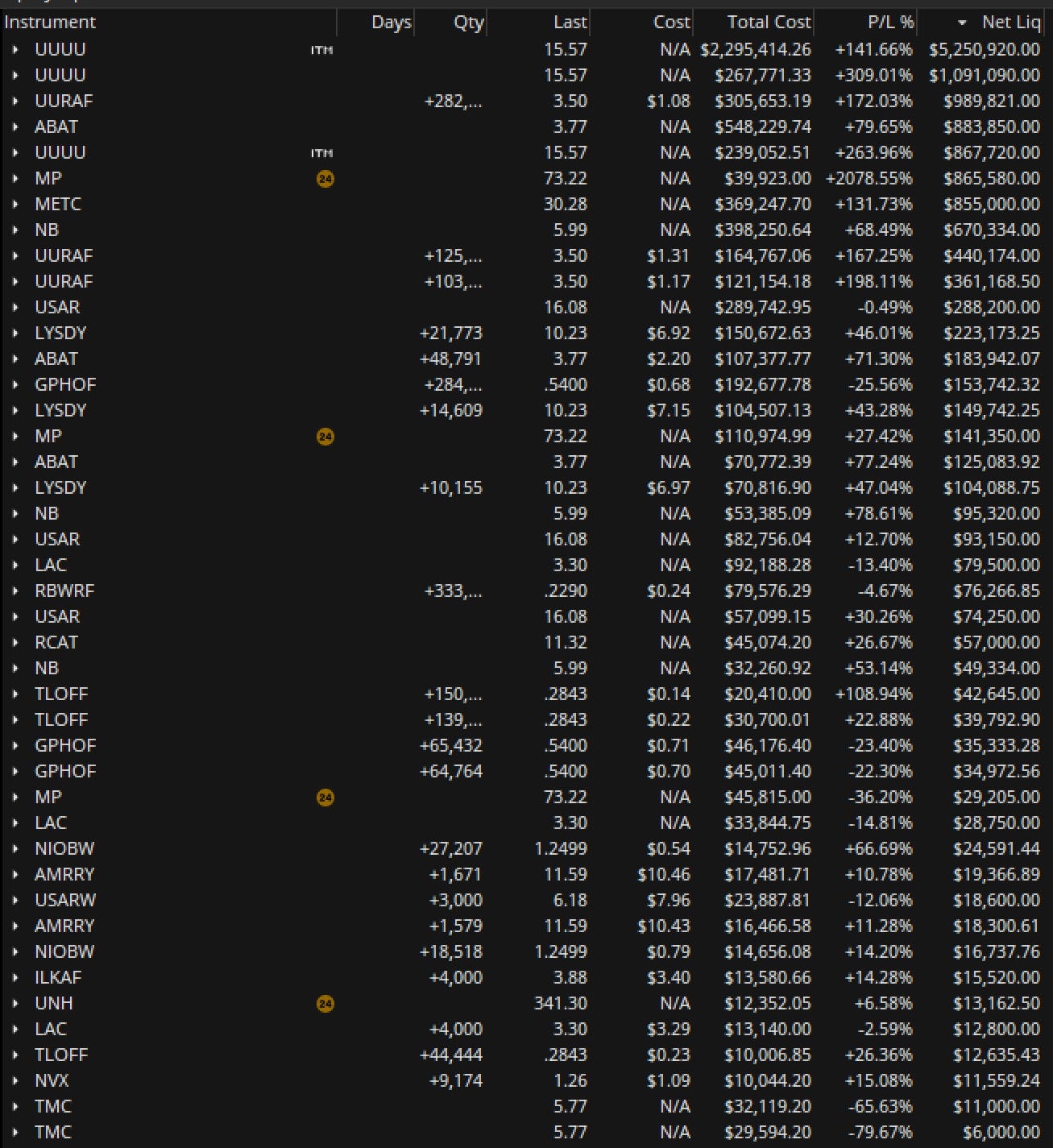

Positions and Portfolio

I receive messages every day from folks with beautiful intentions - to help their families, to build a better life, to lift themselves out of adversity. There are no guarantees in this game we play. All the same, I sincerely hope you will each find ways to realize your dreams. I am stricken by the feeling that there is a large degree of good that ultimately underlies so much of your ambitions.

As always, I love you all and I am wishing you success no matter how you realize it.

Steve

Disclaimer: I am not in the business of giving financial advice. That is, I am not a financial advisor. None of what I say here is a recommendation to hold or not hold shares or other instruments of any particular company or series of companies. All that is contained on my page is research in which I convey and substantiate personal views and commentary about where sectors, economic policies, industries, so on, may go. As always, please do your own research and understand the risks involved before placing any trades. I am not responsible for any of the decisions you choose to make.

BABE STEVE HAS POSTED GET THE WALLET AND SMASH THE PIGGY BANKS

WOW up 76% after hours. Looks like we are getting started!

“Exclusive: Trump administration seeks equity stake in Lithium Americas amid loan talks”

https://www.reuters.com/business/autos-transportation/trump-administration-seeks-equity-stake-lithium-americas-amid-loan-talks-2025-09-23/